- Case StudySelfbook’s New Feature Increases Conversion by 44%

- Case StudyYotel Grows Direct Bookings and Rewards Loyal Guests

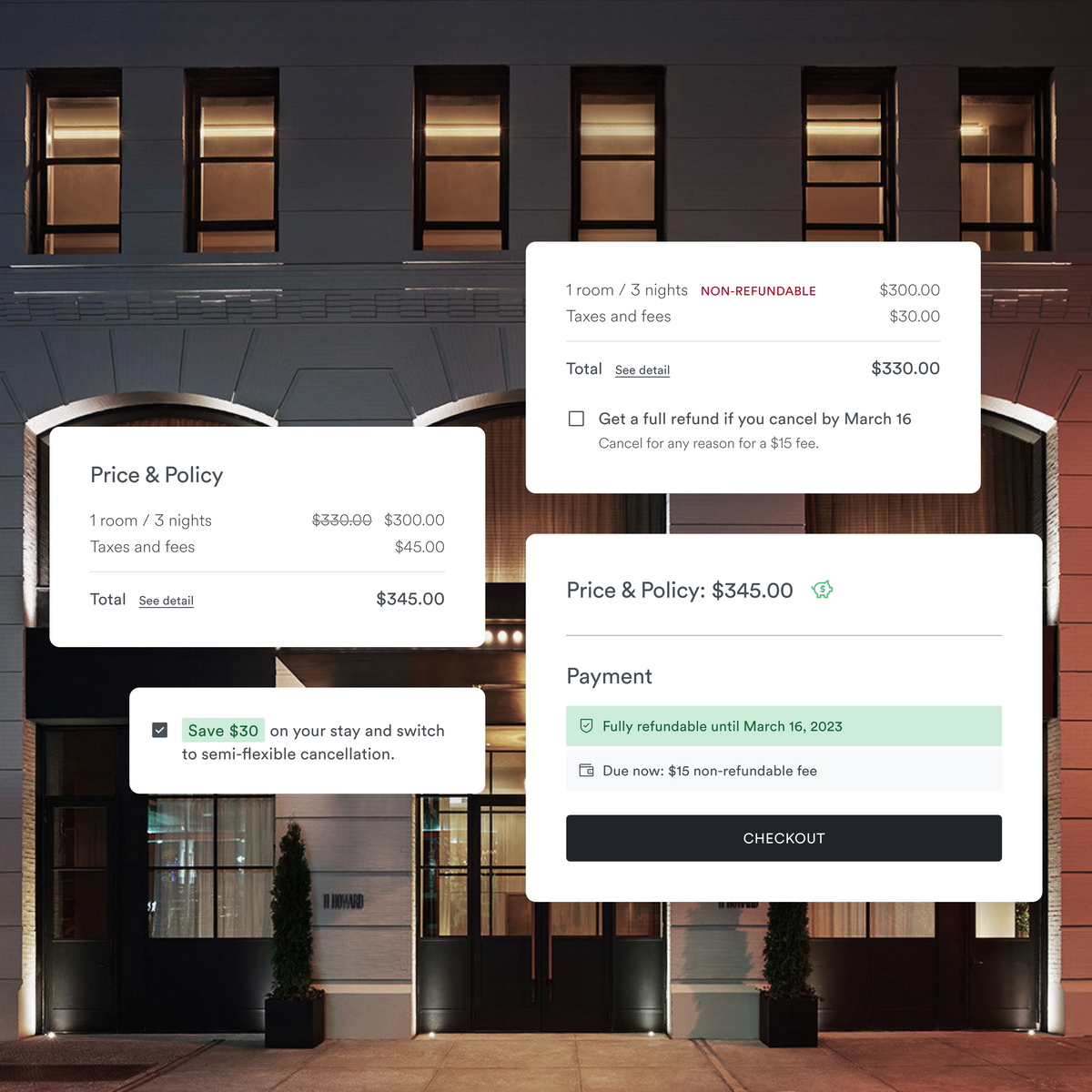

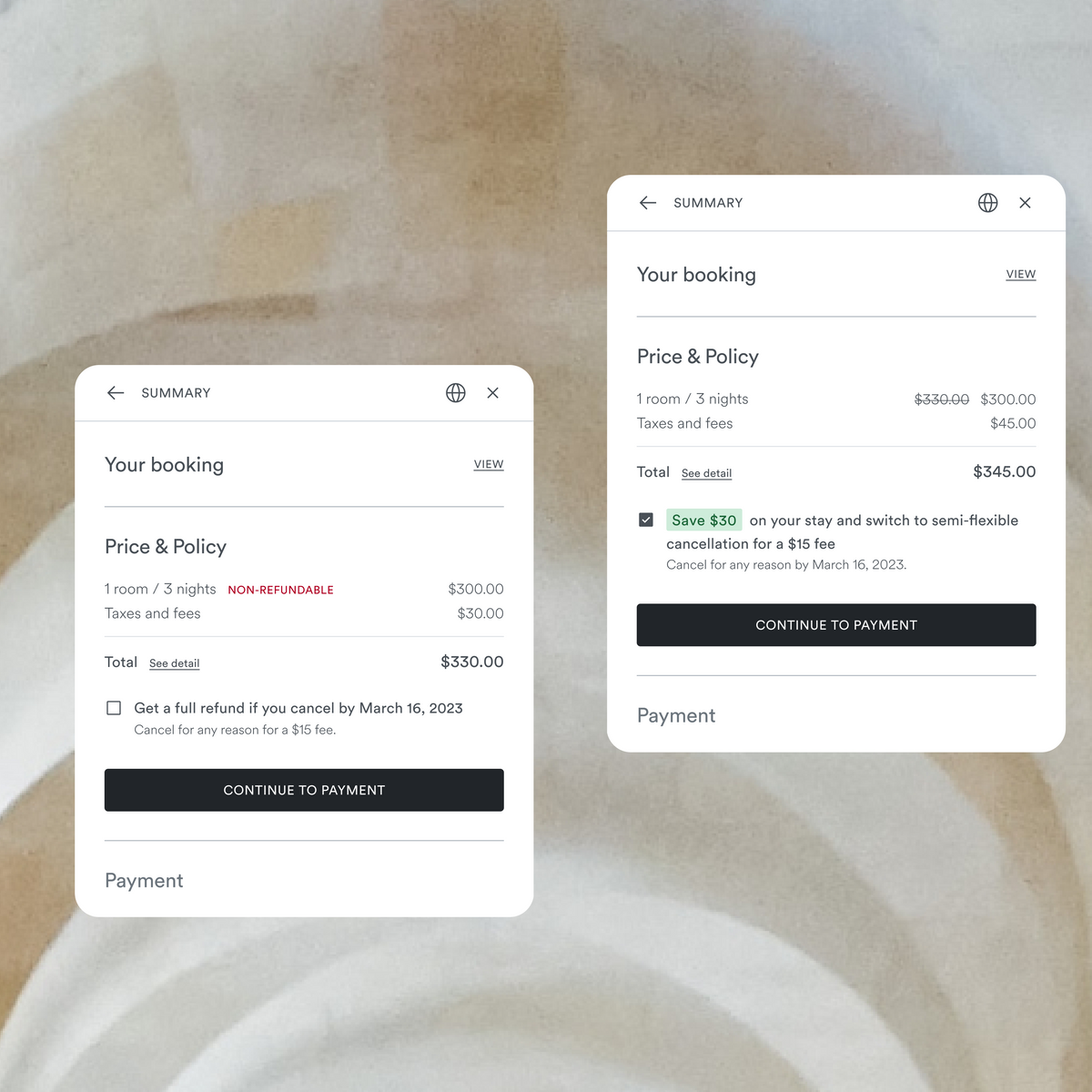

- Case StudyCancellation Rates Down by Over 70% on Flexible Cancellation Bookings for 11 Howard

- NewsRedefining Hotel Commerce in the Age of Agentic AI

- NewsSelfbook Named to Fast Company’s Annual List of the World’s Most Innovative Companies of 2024

- NewsFast Company’s 2023 Innovation by Design Awards

- PartnersPayPal is adding hotel booking, powered by Selfbook

- PartnersSelfbook and Relais & Châteaux Renew Partnership for Second Consecutive Year

- PartnersSelfbook and Preferred Hotels & Resorts Renew Alliance Partnership for Third Consecutive Year

- ProductHow Selfbook Enables Data Privacy for Hotels

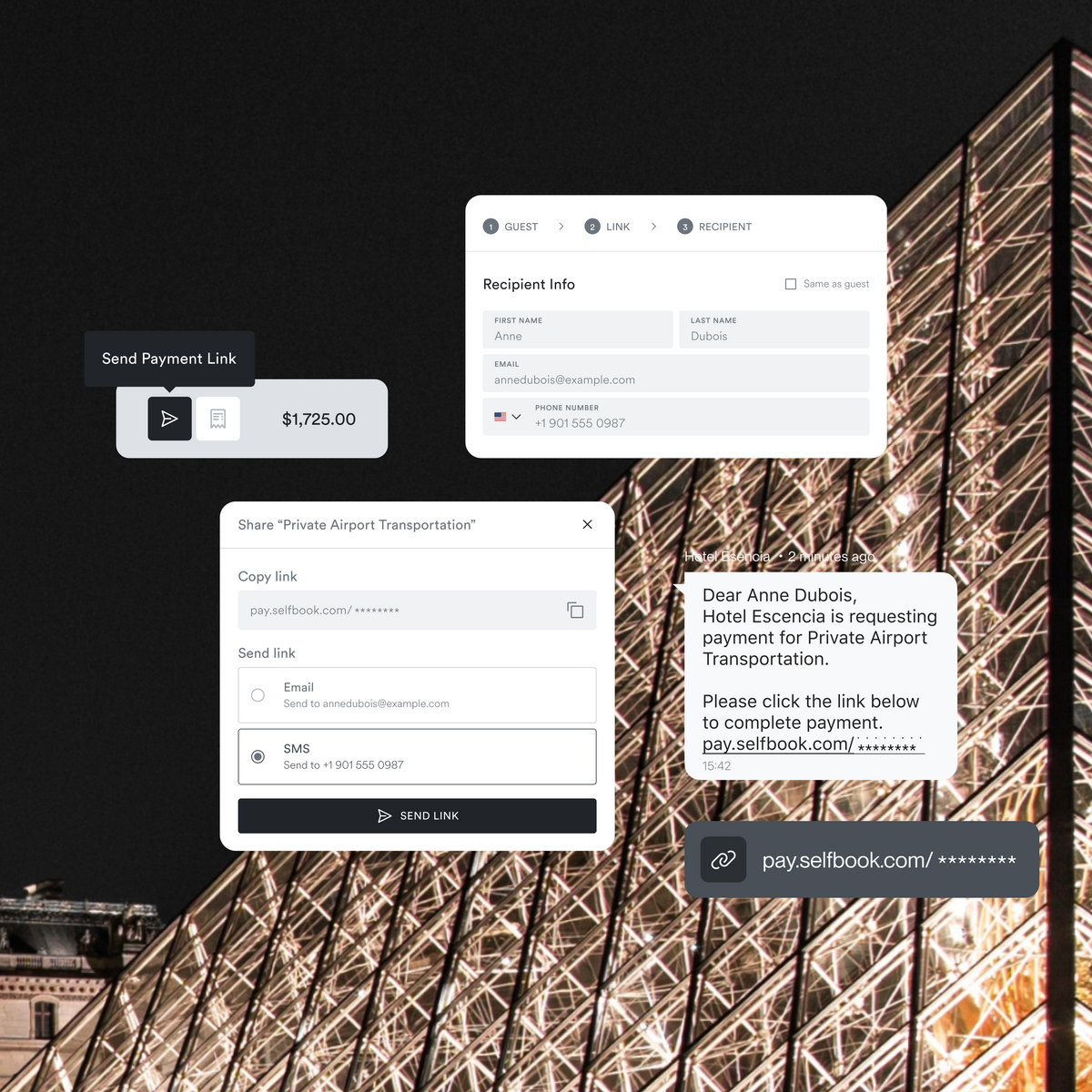

- ProductSelfbook Launches Guest-First Secure Payment Links

- ProductSelfbook Launches Flexible Cancellation for Hotels